Tax Accounting, Payroll & Wage Management - CPD Certified

Holiday into Savings | 11-in-1 Bundle| 115 CPD Points| Gifts: Hardcopy + PDF Certificate + SID - Worth £180

Apex Learning

Summary

- Certificate of completion - Free

- Certificate of completion - Free

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

Boost Your Career with Apex Learning and Get Noticed By Recruiters in this Hiring Season! Get Hard Copy + PDF Certificates + Transcript + Student ID Card worth £180 as a Gift -Enrol Now

From a startup to big-name MNCs, all need Tax Accounting, Payroll & Wage Management for survival! These ultimately influence profitability and impact employees’ experience of any organization. Furthermore, Tax Accounting, Payroll & Wage Management sector is continuously growing, and so is the need for experts in this field.

Tax Accounting, Payroll & Wage Management play a crucial role, from ensuring statutory compliance to providing quantitative financial information. These ensure an organisation is abiding by law while maintaining a healthy work experience. The ISO rule and the growing importance of Tax Accounting, Payroll & Wage Management make it necessary for all employers and employees to be aware of them. This bundle has everything to make aware you of Tax Accounting, Payroll & Wage Management.

Learning Outcomes

- Gain an in-depth understanding of the UK Tax System and Administration.

- Acquire comprehensive knowledge of individual taxation, national insurance, and income tax fundamentals.

- Learn the essentials of Payroll, PAYE, and Wage Management.

- Develop skills in submitting self-assessment tax returns and managing value-added tax.

- Understand the intricacies of Corporation Tax and its implications.

- Master the concepts of Double Entry Accounting and Management Accounting for insightful financial analysis.

Along with this Tax Accounting, Payroll & Wage Management bundle, you will get 10 premium courses, an original Hardcopy, 11 PDF Certificates (Main Course + Additional Courses) Student ID card as gifts.

This Tax Accounting, Payroll & Wage Management Bundle Consists of the following Premium courses:

- Course 01: Level 3 Tax Accounting

- Course 02: Payroll Management - Diploma

- Course 03: Accounting and Bookkeeping Level 2

- Course 04: Sage 50 Training

- Course 05: Wages & Benefits

- Course 06: Law and Contracts - Level 2

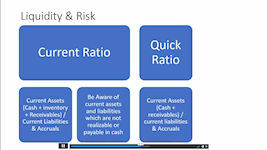

- Course 07: Financial Analysis

- Course 08: Level 3 Xero Training

- Course 09: Level 2 Microsoft Office Essentials

- Course 10: GDPR Data Protection Level 5

- Course 11: Time Management

Key features of this Tax Accounting, Payroll & Wage Management bundle:

- This Tax Accounting, Payroll & Wage Management bundle is CPD QS Accredited

- Learn from anywhere in the world

- Lifetime access

- Our Tax Accounting, Payroll & Wage Management is entirely online

- 24/7 Learner support

So, Enrol Tax Accounting, Payroll & Wage Management bundle course now to advance your career!

CPD

Course media

Description

Through this Tax Accounting, Payroll & Wage Management bundle, you will acquire knowledge about the tax and insurance system in the UK. Furthermore, you will gain proficiency in payroll management and financial analysis. Moreover, you will familiarise yourself with different laws. Additionally, you will acquire skills for efficient use of Microsoft Office essentials.

The course Curriculum of Tax Accounting, Payroll & Wage Management Bundle:

Course 01: Level 3 Tax Accounting

- Module 01: Tax System and Administration in the UK

- Module 02: Tax on Individuals

- Module 03: National Insurance

- Module 04: How to Submit a Self-Assessment Tax Return

- Module 05: Fundamentals of Income Tax

- Module 06: Payee, Payroll and Wages

- Module 07: Value Added Tax

- Module 08: Corporation Tax

- Module 09: Double Entry Accounting

- Module 10: Management Accounting and Financial Analysis

- Module 11: Career as a Tax Accountant in the UK

=========>>>>> And 10 More Courses <<<<<=========

How will I get my Tax Accounting, Payroll & Wage Management Bundle Certificate?

After completing the Tax Accounting, Payroll & Wage Management Bundle, you will be able to order your CPD Accredited Certificates (PDF + Hard Copy) as proof of your achievement.

- PDF Certificate: Free (Previously it was £10 * 11 = £110)

- Hard Copy Certificate: Free (For The Title Course)

P.S. The delivery charge inside the U.K. is £3.99 and international students have to pay £9.99.

Who is this course for?

Premium Tax Accounting, Payroll & Wage Management Bundle:

- Individuals aspiring to become proficient in Tax Accounting.

- Professionals seeking to update their knowledge in UK tax regulations.

- Entrepreneurs wanting to manage their business finances effectively.

- Career changers looking to enter the field of Tax Accounting.

Requirements

Our Tax Accounting, Payroll & Wage Management bundle is fully compatible with PC’s, Mac’s, laptops, tablets and Smartphone devices. This course has been designed to be fully compatible with tablets and smartphones, so you can access your course on Wi-Fi, 3G or 4G.

There is no time limit for completing this Tax Accounting, Payroll & Wage Management bundle; it can be studied in your own time at your own pace.

Career path

Having this Tax Accounting, Payroll & Wage Management expertise will increase the value of your CV and open you up to multiple job sectors.

- Tax Accountant: £35,000 - £50,000

- Payroll Manager: £30,000 - £45,000

- Financial Analyst: £40,000 - £55,000

- Corporate Tax Advisor: £45,000 - £60,000

- Management Accountant: £38,000 - £52,000

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Certificates

Certificate of completion

Digital certificate - Included

Certificate of completion

Hard copy certificate - Included

You will get the Hard Copy certificate for the title course (Level 3 Tax Accounting) absolutely Free! Other Hard Copy certificates are available for £10 each.

Please Note: The delivery charge inside the UK is £3.99, and the international students must pay a £9.99 shipping cost

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.